Mechanical engineering

Investment proposals

The share of mechanical engineering in the economy is 1.5%, in the manufacturing industry – 13%.

Last year, a record amount of investment was attracted to mechanical engineering – $462.4 million.

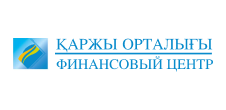

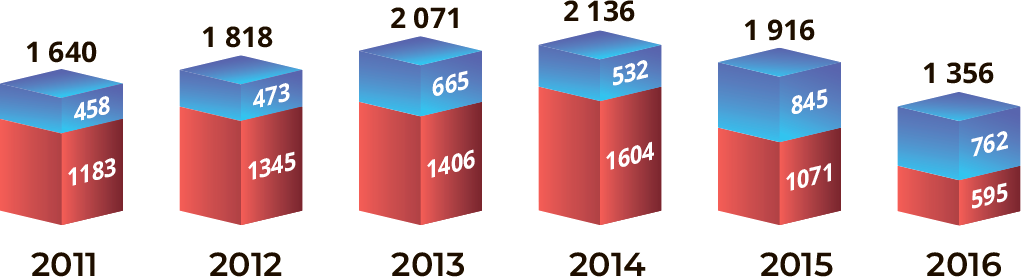

Foreign direct investments in mechanical engineering, $ million

Production volumes by type of economic activity, %

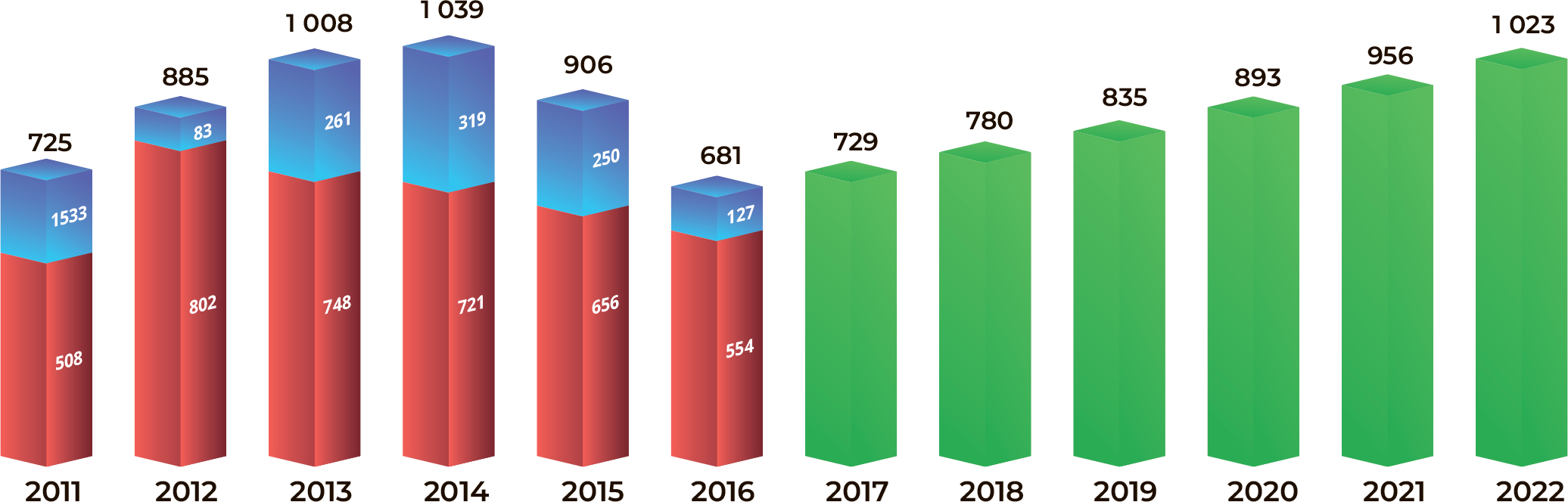

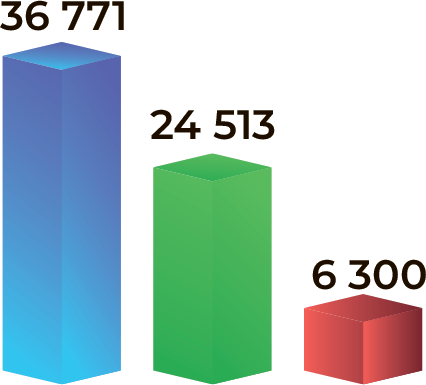

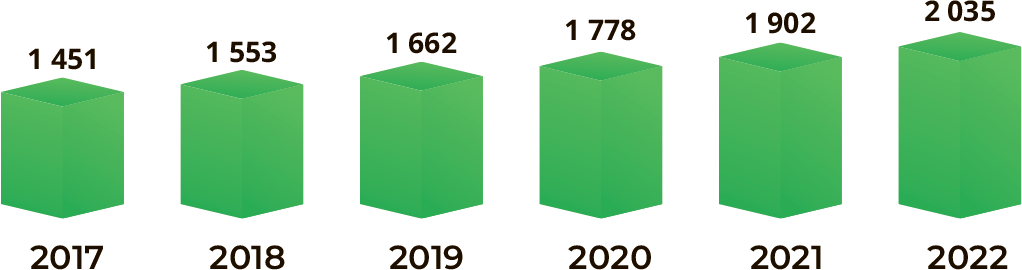

Volumes of production, imports and exports in the mechanical engineering of the Republic of Kazakhstan, $ billion

Every year the demand exceeds local production capacity by 3,5 times

$ bln

Every year, almost half of Kazakhstan’s imports accounts for mechanical engineering products

In Kazakhstan there are 20,8 thousand enterprises in the manufacturing industry and 4 thousand in mechanical engineering

- - raw materials

- - competencies

- - technologies

- - stable demand

- - competitive environment

- - logistics

The total need of the agro-industrial complex for basic means of mechanization and automation includes more than 1.5 thousand items.

The Ministry of Industry and Construction, together with the Ministry of Agriculture, adopted a document excluding subsidies for foreign agricultural machinery, analogues of which are produced in Kazakhstan. The exclusion of subsidies for foreign agricultural machinery does not affect those items whose production is not established in Kazakhstan, namely specialized equipment for the production and harvesting of sugar beets, cotton, potatoes and fruits and vegetables, etc. In this case, a subsidy standard of 25% is provided, regardless of the country production.

- Includes subsidizing interest rates on agricultural equipment leasing and credit provision;

- Providing agricultural producers with access to finance, technology, and technological equipment on a leasing basis;

- Offering comprehensive support to export-oriented enterprises in the non-resource-based sector of the economy;

- Reimbursing costs associated with product promotion for export, trade finance, and insurance (up to 50%).

Production of tractors aimed at import substitution in the domestic market of Kazakhstan and for export to the Russian Federation.

- The planned increase in agricultural land in Kazakhstan and the consolidation of agricultural producers;

- High need to update the agricultural machinery fleet (with wear of more than 80%);

- State support for agricultural producers in purchasing new equipment;

- Duty-free access to the large market of the Russian Federation.

Production of a wide range of electrical cables aimed at import substitution in the domestic market of Kazakhstan.

- High need of upgrading worn equipment for power transmission;

- Planned investments in the modernization of the electricity industry;

- The lack of production facilities of international players in the market of Kazakhstan,

Main importing countries are Russia, China

Market potential by 2020

Due to the consideration of the need of upgrading power transmission lines, by 2020 the expected

volume of the market of cabling and wiring products will amount about $ 500 million

- requires replacement

- does not require replacement

- Expansion of Tengiz field during the period of 2017-2021, about $ 37-40 billion investment;

- Expansion of Karachakanakskoye field, about 4.5 billion USD of investment.

In the unfavorable market conditions of the oil and mining industries, companies reduce the cost of purchasing new equipment and concentrates on increasing the efficiency and repair of working equipment, which is a favorable factor for the development of engineering maintenance service.

At the end of 2022, total imports of oil and gas and mining engineering reached $2,7 billion, while production volume amounted to $114 million.

According to the order of the Head of State to achieve carbon neutrality by 2060, specific target indicators are provided for achieving a 15% share of renewable energy sources by 2030, 50% by 2050, taking into account alternative energy sources.

To achieve the 2030 goal, about 7 GW of new renewable energy capacity will be required. Accordingly, the localization of production of wind farm components in Kazakhstan becomes an even more pressing issue.

As of March of this year, there are 147 renewable energy facilities in the country with a total capacity of 2.9 GW, of which wind power plants (WPP) are 59 facilities (1.4 GW). At the same time, all wind farm components are imported from China and Russia with a zero degree of localization.

In 2018-2022 alone, Kazakhstan imported more than 24 thousand tons of these products worth $990 million.

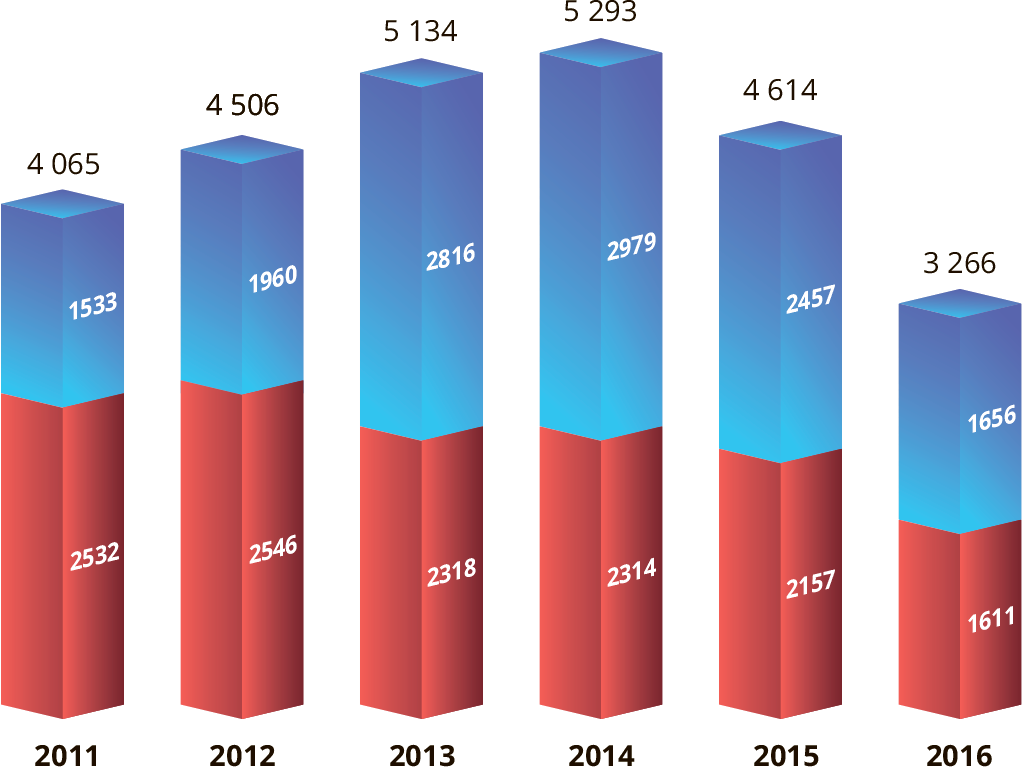

Import of wind farm towers to Kazakhstan ($ mln)

Import of wind farm towers to Kazakhstan (ths tons)

Imports from neighboring Central Asian countries amounted to 25,7 thousand tons of these products worth $70 million. According to experts, in the next 5 years the total demand for the wind energy sector in Central Asian countries will range from 30 to 98 thousand tons per year.

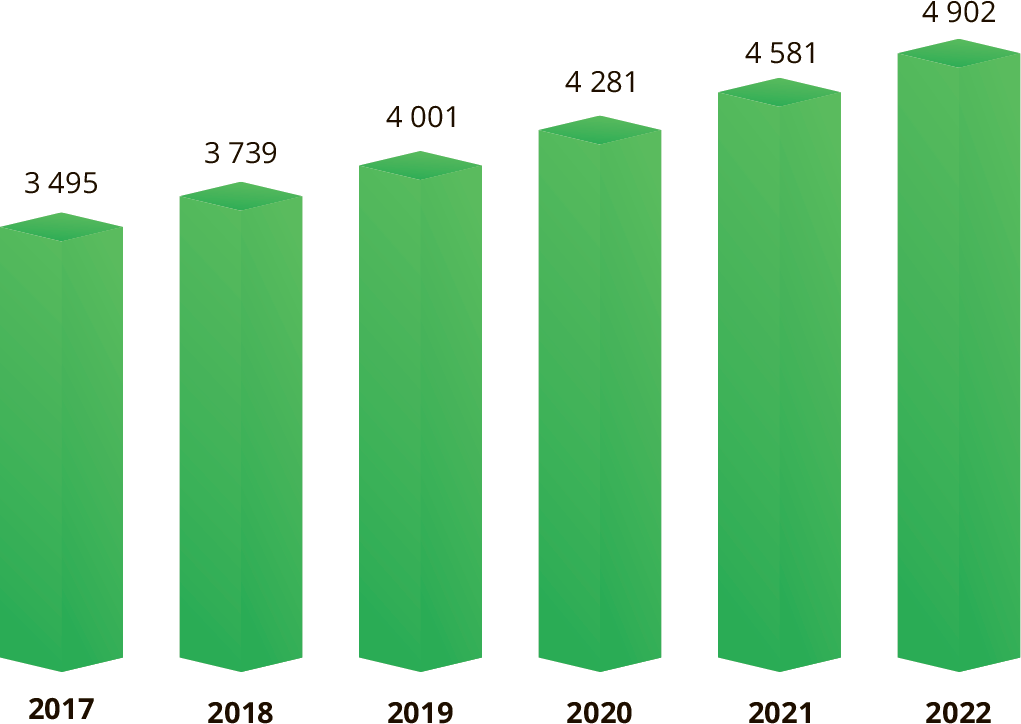

Import of wind farm towers to other Central Asia countries ($ mln)

Import of wind farm towers to other Central Asia countires (ths tons)